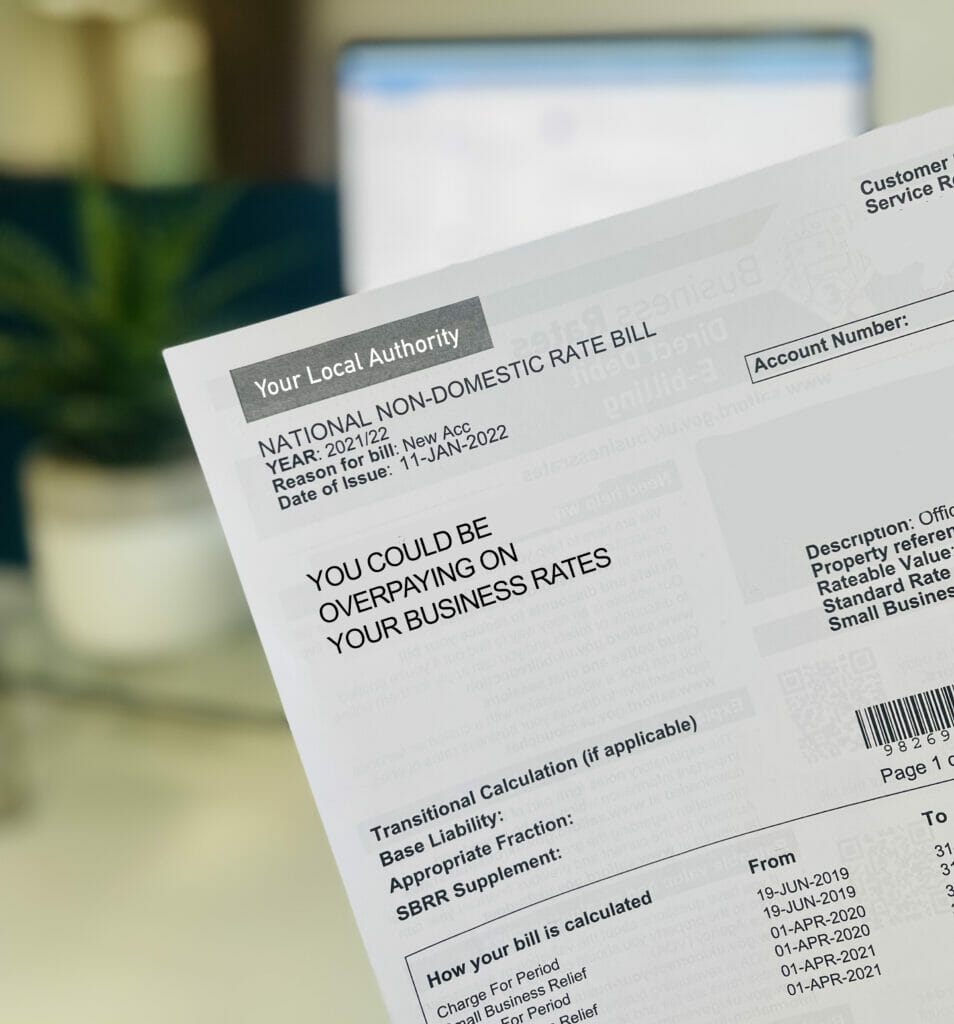

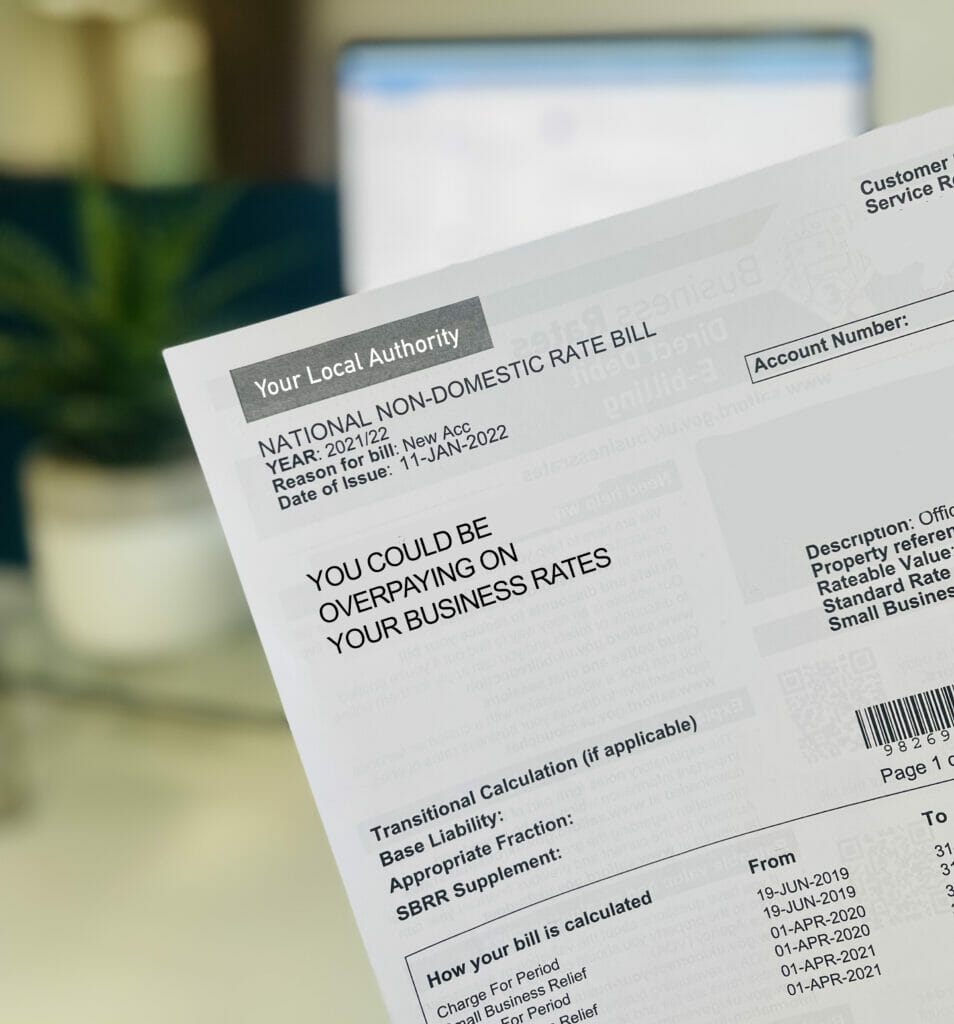

It’s official: 1 in 3 Business Rates bills are incorrect

16 May 2023, by Verity Editor

16 May 2023, by Verity Editor

That’s a worrying stat*, and unless you are a Rating Expert you probably won’t know whether yours is one of them, which means you could be overpaying for no good reason!

Your Rates bill needs to be checked properly by a Rating Specialist who will challenge the VOA if a discrepancy is found. Once successful, your Rateable Value will be reduced which means your Rates bill will be less and you could receive a refund as far back as 2017. 98% of rates bills challenged by Verity have resulted in a reduction and refund.

We recently submitted a Check Case Appeal on behalf of Pyroguard, the leading provider of fire safety glass systems. The original Rateable Value of their property was £72,000. The case was submitted, and when it concluded 12 days later, the new Rateable Value was £65,500. Thanks to us, the saving and refund for the current rating list period is £16,500 – a dispiriting amount to be overpaying, to say the least!

Another example: the Local Authority issued a back dated bill to our client (effective 1st April 2017) for payment of Business Rates totalling £58,030 for a piece of land they owned that was not previously assessed for Rates. The land was initially assessed with a Rateable Value of £30,000. Our client instructed Verity to deal with the appeal, and we agreed a reduction in the assessment with the Valuation Officer to an updated Rateable Value of £7,100. The client was then able to claim 100% Small Business Rate Relief and the debt was cleared, meaning they owed nothing.

All you need to do is send us your Rates bill and we will tell you if something is wrong! If we do challenge the VOA and reach a successful outcome, you pay a small cut of the savings we achieve. No savings – no cost to you at all. It’s a no brainer.

Stop paying unnecessary Business Rates on your commercial properties. Start spending your money on things you really want or need.

Our Rating Experts specialise in challenging, appealing, valuating, splitting, and merging of properties. We can help ratepayers get a refund on their overpayments, as far back as 2017. Our specialists will provide free, expert advice and have over 30 years’ experience, so you’ll be in safe hands!

Get in touch with our Head Rating Specialist, Mark Bates, by calling 0161 883 1675 or simply send your rates bill to check@veritygroup.uk

We use Verity Management Services to assist with reducing vacant business rates. They are friendly, efficient, and prompt, and would happily recommend them.

Elliot Shalom